Prodigy.Fi Product 101 Series: Not Sure Which Vault to Pick? Here’s How to Decide

Welcome to the ninth edition of the Prodigy.Fi Product 101 Series! Your trusted guide to all things Prodigy.Fi. If you are just joining us, we recommend starting from the earlier editions to catch up (we have covered a lot about DCIs and how they work!).

You can catch up on them here.

Alright so, you have landed on Prodigy.Fi and want to start earning with Dual Investment vaults, but you are staring at the vault options thinking, “Where do I even begin?”

Well, you are not alone.

One of the most common questions we get from new Brodigies is: “How do I choose the right vault?” With multiple assets, prices, and timeframes to consider, it can feel overwhelming. So this article breaks it down for you, step-by-step, and introduces you to a simple mental model that makes vault selection feel a whole lot easier.

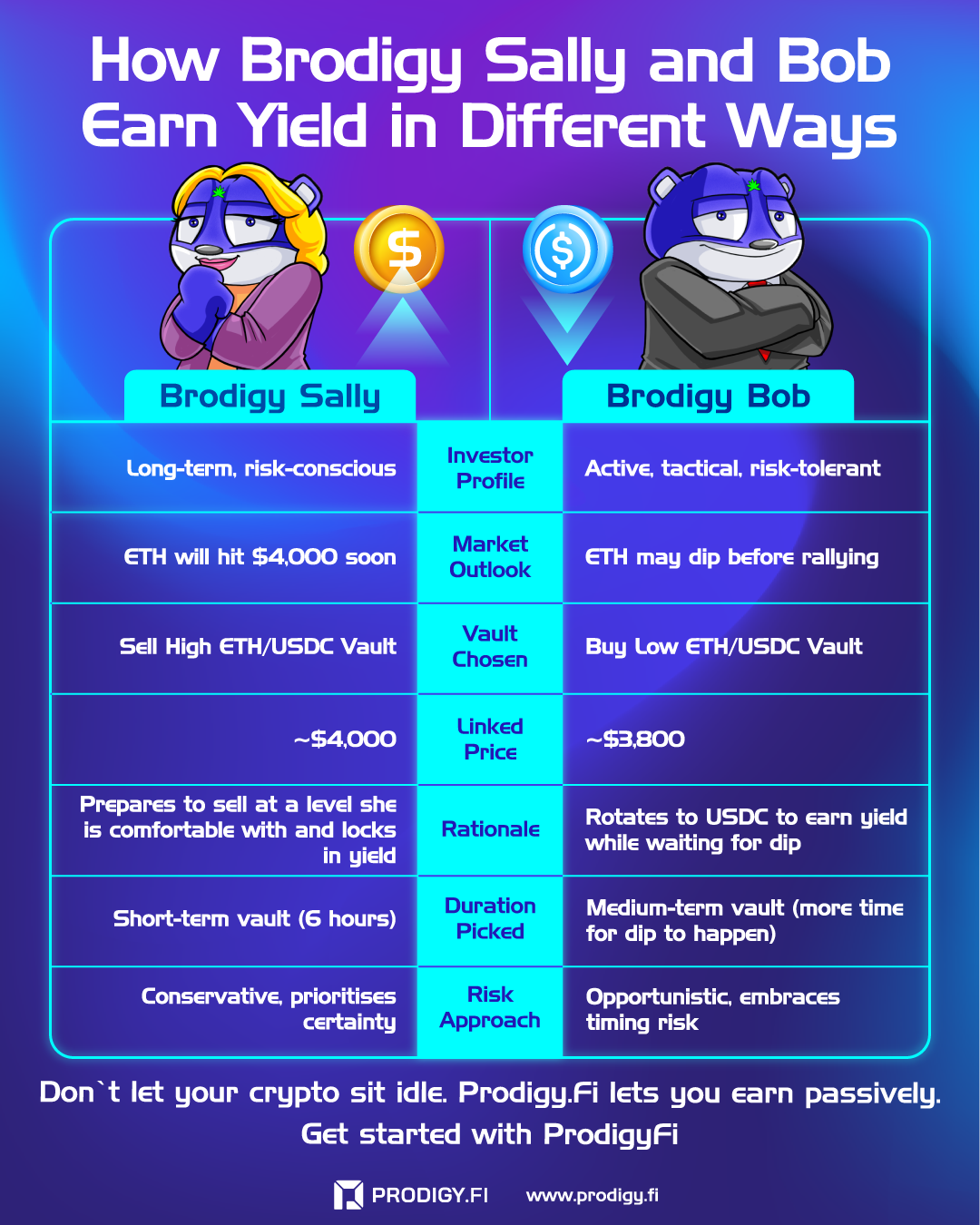

Whether you are risk-on like Brodigy Bob or prefer to play it safe like Brodigy Sally, let’s figure out which vault is right for you.

Key Takeaways

Start by identifying what asset you are holding and your market view. This determines whether you should choose a Buy Low or Sell High vault.

Align the vault’s expiry with your investment timeframe.

Choose a realistic Linked Price based on market trends and your risk appetite.

Use the Swap Likelihood tool to gauge how probable your vault is to execute, and adjust your strategy accordingly.

Pick vaults that suit your risk profile, whether you prefer safer, high-likelihood trades or riskier, high-reward plays.

Step 1: Choose Your Asset Pair and Market Direction

Before deciding whether to Buy Low or Sell High, start by thinking about what you hold and what you have a view on.

- Are you holding ETH but more bullish on cbBTC’s price action? Then it might make more sense to choose a cbBTC/USDC pair — not ETH/USDC — if you are looking to trade based on your view.

- Do you have USDC sitting idle, but believe cbBTC is due for a run? That could be your signal to explore Buy Low vaults on that token.

You can also check out the full breakdown of assets supported on Prodigy.Fi here.

It starts with two key questions:

- Which assets are you holding right now? (Read: this is the token you will deposit.)

- Which asset do you have a strong view on? (Read: this informs which vault pair and direction you pick.)

From there, you will make a directional choice:

- If you think the target asset will go up, and you want to sell at a profit, choose a Sell High vault.

- If you believe the market might dip, and want to accumulate tokens at a discount, opt for a Buy Low vault.

Tip: The token you deposit is the one that earns yield. So if you deposit ETH into a Sell High vault, you’ll either sell ETH at your linked price or keep it and still earn a yield. Likewise, depositing USDC into a Buy Low vault gives you exposure to a token like LINK and yield, whether or not the market swings in your favour.

Here are some examples.

Brodigy Sally is sitting on idle ETH. ETH has been hovering around $3,900 over the past week, and she’s been doing her research — reading the charts, watching market sentiment on Crypto Twitter, and tracking ETH ETF inflow data. She believes based on her research that ETH will soon push past $4,000. To prepare for that possibility, she chooses a Sell High ETH/USDC vault, setting her Linked Price at $4,000. This way, if ETH hits that level, her ETH gets sold at the price she wants and she earns a fixed APY in the process. Since she is more conservative, she opts for a shorter duration (say, 6 hours), anticipating a near-term move.

Brodigy Bob, on the other hand, is more of an active trader. He sees that ETH has tested $3,900 a few times recently and suspects it may pull back before any sustained move higher. Rather than holding ETH and risking downside, Bob decides to rotate into stablecoins and subscribe to a Buy Low ETH/USDC vault, setting his target at $3,800. If ETH dips, he will scoop up ETH at that price, and earn interest while waiting. If it does not, he keeps his USDC plus the yield.

Ultimately, each directional strategy allows you to choose your Linked Price and Expiry, and no matter the outcome, you will earn a fixed yield.

Step 2: Choosing the Right Vault Pair

Once you have selected Buy Low or Sell High, the next step is selecting the vault that fits your view of the market. This is where Prodigy.Fi’s wide asset range and vault parameters give you full control over how you deploy capital.

Here’s what you need to consider:

Expiry Date

The first parameter to look at is the Expiry. On Prodigy.Fi, vaults have expiry dates ranging from as short as 4 hours to as long as 2 days and 23 hours. This short tenor is a feature, not a limitation. This gives you the flexibility to choose between quick, tactical plays or slightly longer-term strategies, depending on how you see the market moving. It also allows you to stay nimble, react quickly to market conditions, and rotate capital more frequently compared to other DeFi products that lock you in for weeks or months.

Short expiries are ideal for traders who have a near-term market view or prefer to compound yields across multiple cycles. Instead of waiting for long horizons to see outcomes, Prodigy.Fi vaults give you the flexibility to execute tactical trades and re-deploy capital with clarity every few days.

If you believe ETH will test $4K in the next 24–48 hours, you can select a vault expiry that aligns with that timeframe without over-committing or unnecessary lock-up. On the flip side, if you prefer a slightly longer window for your strategy to play out, you can opt for vaults with up to 2 days and 23 hours expiry.

The key advantage? You remain in control of your capital, whether you want to stay tactical or build a rhythm of steady, short-cycle yields.

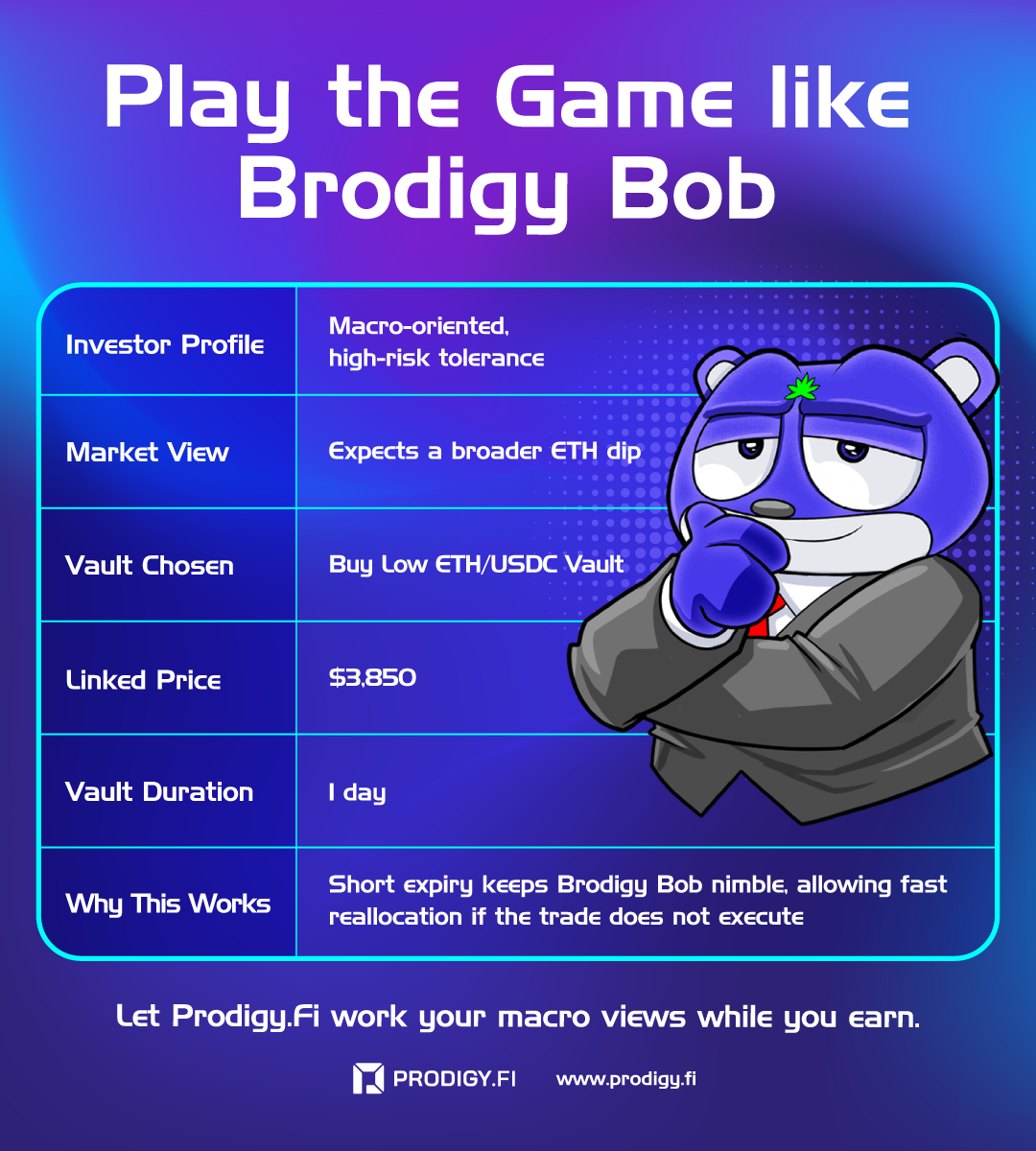

Let’s continue with the example of Brodigy Bob.

Brodigy Bob is expecting a broader market dip. He has been watching ETH fail to break $3,900 for weeks and thinks a pullback could happen soon, maybe within the next few days. Rather than locking up his capital in a long-term product, Brodigy Bob uses Prodigy.Fi’s short-tenor Buy Low ETH/USDC vaults to stay flexible.

He subscribes to a Buy Low vault with a 1-day expiry and a Linked Price of $3,850. While the shorter expiry means a tighter window for his trade to execute, Bob likes the fact that he can reassess and redeploy his capital quickly if the market does not move in his favour.

The vault also offers a higher APY, which Bob is comfortable with given his tactical approach. If ETH does not reach his target in that time, his USDC still earns yield, and he can immediately roll into another vault based on how the market evolves.

Linked Price

Linked Price is one of the most critical parameters when choosing a vault. This is the price at which the vault will execute a swap. For example, selling your ETH into USDC or buying ETH with your USDC. Picking the right Linked Price depends on your market view, your risk appetite, and how much yield you are aiming for. You may notice that some vaults have very similar Linked Prices, sometimes just $50 apart. While they may look interchangeable, they can reflect very different strategies and levels of risk.

Let’s bring this to life with Brodigy Sally. She is bullish on ETH, which is currently trading at $3,900, and wants to sell only if it breaks a key resistance level. She looks at a range of Sell High ETH/USDC vaults. One with a $3,950 target, and others at $4,000 and $4,150. Since Brodigy Sally is more conservative, she picks the $3,950 vault. It is aligned with her short-term conviction and offers a balance between achieving a realistic price and earning yield without taking on too much risk that her trade does not execute.

Ultimately, your Linked Price should reflect your market thesis and how much risk you are comfortable taking in exchange for yield.

Swap Likelihood

On Prodigy.Fi, Swap Likelihood tells you how likely your vault deposit (subscription) will get swapped upon Expiry, based on real-time market data like price volatility, difference between current vs linked price, and time remaining. However, unlike traditional options where deeper out-of-the-money strikes pay more, Prodigy.Fi’s vaults balance risk and reward dynamically. Vaults with higher Swap Likelihoods on our platform often offer higher APYs because they reflect live market demand and conditions. This means a vault that has a stronger chance of swapping might also present an attractive yield opportunity.

On the other hand, users who simply want to earn yield without swapping into another asset may prefer lower Swap Likelihoods. In this case, execution is less likely, their principal stays in the original token, and they still earn the vault’s yield.

Use Swap Likelihood as a strategic filter. It gives you a live reading of your vault’s odds of executing before expiry, and helps you balance between realistic market moves and yield expectations.

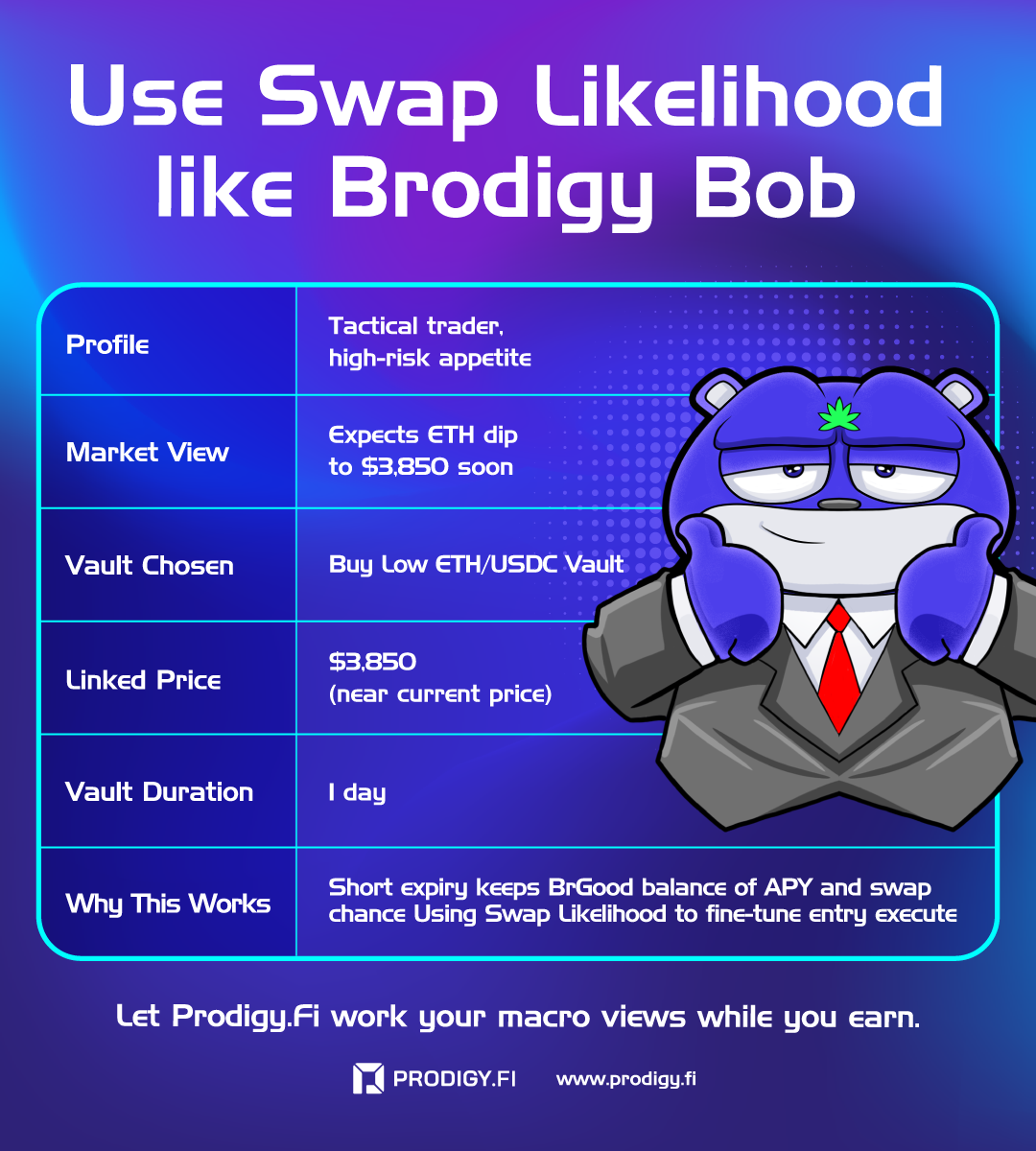

For example, Brodigy Bob is eyeing a Buy Low ETH/USDC vault. ETH is currently trading at $3,900, and he is considering a Linked Price of $3,850, a level ETH has recently tested but has not firmly broken below. He checks the Swap Likelihood indicator, which shows a relatively higher reading, indicating a stronger chance that ETH could dip to $3,800 before the vault expires in 1 day.

Because this Linked Price is close to the current market level, the APY offered is still attractive. Brodigy Bob likes this balance and he is positioning for a reasonable price dip without needing an extreme market move, giving him a better chance of converting his USDC into ETH while still earning yield.

By using Swap Likelihood as a guide, Brodigy Bob is aligning his strategy with a realistic market scenario, ensuring that he is not just chasing the highest APY but also giving himself a strong probability of executing his trade.

APY

APY (Annual Percentage Yield) is the fixed return you will earn on your deposit, no matter whether your vault’s Linked Price is reached or not. It is a key figure that helps you evaluate the reward side of the risk-reward equation when choosing between vaults.

On Prodigy.Fi, APYs vary across vaults based on factors like expiry duration, asset pair, and current market dynamics. When you are choosing between vaults, comparing APYs helps you assess the opportunity cost of locking your funds for a certain period too. The beauty of Prodigy.Fi’s vaults is that you earn a guaranteed APY regardless of whether the price target is hit, so every vault subscription can be a strategic yield play.

Step 3: Match Your Strategy to Your Risk and Market View

Choosing a vault is ultimately about aligning your market outlook, risk appetite, and time horizon.

- More conservative? Stick to vaults with lower Swap Likelihoods, where the Linked Price is further from the current market level and expiry is shorter. These generally offer lower APYs and a smaller chance of execution, keeping your principal in the original token while still earning yield.

- More aggressive? Opt for vaults with higher Swap Likelihoods, often with Linked Prices closer to current levels. These typically offer higher APYs and a greater chance of executing (swapping into the target asset).

Remember: Even if your vault does not “swap”, you will still earn yield and retain your original asset. This built-in downside protection is one of the reasons Dual Currency Investment (DCI) vaults are so powerful especially when used strategically over time.

You can also optimise over time by:

- Subscribing during higher volatility periods for higher potential returns

- Subscribing to a few different vaults to diversify your risk

- Using Swap Likelihood to assess your strategy’s odds

You can read up on different strategies you can use on Prodigy.Fi here.

The more you observe and iterate, the more confident and precise your vault strategy becomes.

How Would You Decide?

Let’s bring it all together with a few real-world situations. These examples show how users can assess similar vaults and make decisions based on their market view, timing, and risk tolerance.

Scenario 1: Three Sell High Vaults, All ~350% APY

Brodigy Bob and Sally see three Sell High ETH/USDC vaults, all offering roughly 350% APY but each with different expiry dates and linked prices.

- Vault A: Expires in 4 hours, at $3,850 with 406.29% APY

- Vault B: Expires in 2 days 4 hours, at $3,750 with 397.49% APY

- Vault C: Expires in 2 days 4 hours, at $3,775 with 324.22% APY

Brodigy Bob, the tactical trader, believes ETH could spike soon. He chooses Vault A for its ultra-high APY and short expiry. He is willing to take the risk for a potential quick win, even though the Swap Likelihood might not be the highest. To balance that high-risk position, he also subscribes to Vault B, which has a longer expiry, solid APY, and the highest Swap Likelihood of the three. This gives him exposure to both short-term upside and more probable execution, a smart way to diversify his strategy.

Brodigy Sally, on the other hand, values certainty over maximum return. She chooses Vault B as well. Not because of the high yield, but because it offers the strongest chance of executing (ie: it has the highest Swap Likelihood). Even though the Linked Price is lower, she is happy to lock in a likely outcome and secure her yield with less risk.

Scenario 2: Same Linked Price, Different APYs

There are two Buy Low ETH/USDC vaults, both with a linked price of $4,300 but different APYs and expiries.

- Vault D: Expires in 20 hours, 305.01% APY

- Vault E: Expires in 1 day 20 hours, 227.97% APY

Brodigy Bob, the more active and risk-tolerant trader, picks Vault D. Even though it has a shorter expiry, he is betting on a quick dip in ETH and is willing to accept more risk for a higher APY and faster resolution. If the vault does not execute, he is fine repositioning quickly.

Brodigy Sally, being more risk-averse, chooses Vault E. She is satisfied with a slightly lower APY if it means giving ETH more time to reach her Linked Price. The longer expiry increases the likelihood of success, which aligns with her preference.

Build Your Strategy, One Vault at a Time

Every user’s strategy is different and that’s exactly why Prodigy.Fi supports so many tokens, expiry choices, and risk profiles. Whether you are just getting started or looking to diversify, this flexibility lets you approach the market with confidence.

More insights, less fluff. Follow to keep learning.

✱ Website: https://prodigy.fi/

✱ Web App: https://mainnet-base.prodigy.fi/earn

✱ X: https://x.com/ProdigyFi

✱ Telegram: http://t.me/@prodigyfi

✱ Discord: https://discord.gg/PBKGN76YDn

✱ Youtube: https://youtube.com/@prodigyfi_official