Why Are Prodigy.Fi Yields So High? Lets Break Down the Mechanics

If you have browsed Prodigy.Fi’s vaults, you have probably noticed the eye-catching yields, which are sometimes — or most of the time — far higher than what you will find on other lending or staking protocols. And if you are wondering how that is possible without any party getting squeezed, you are not alone.

The truth is, Prodigy.Fi’s yields are not powered by token incentives or magic math. They come from real market activity, a transparent onchain exchange of risk and reward that works a lot like reverse insurance.

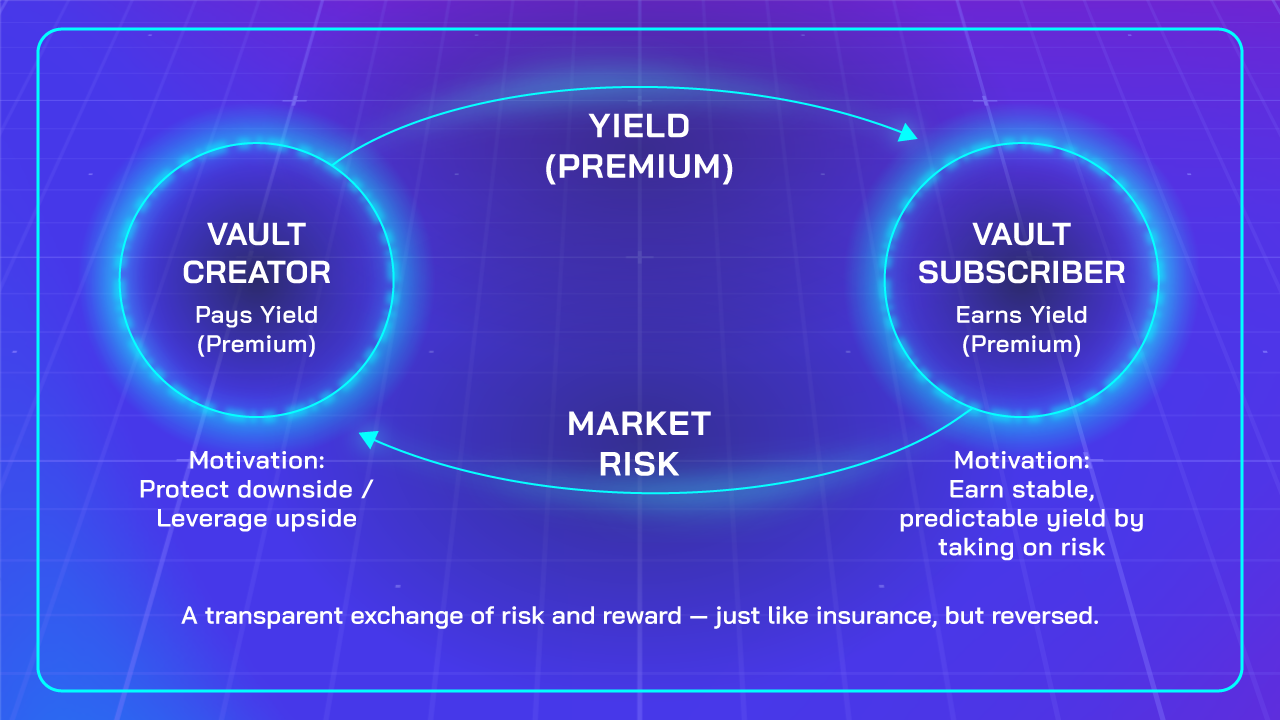

In traditional insurance, you pay a premium to protect yourself from risk. In Prodigy.Fi, it’s flipped. You get paid a premium for agreeing to take on risk. That is the essence of how Dual Currency Investments (DCIs) work: Vault Creators pay yields (premiums) to Vault Subscribers, who earn those yields in exchange for underwriting defined market risk. It is essentially a win-win situation for both Vault Creators and Vault Subscribers where both sides benefit from a transparent exchange of risk and reward.

Now, let’s break it down.

The Source of Yield

Every yield on Prodigy.Fi’s Dual Currency Investment (DCI) vaults comes directly from Vault Creators (read: the users who set up the vaults) and securely locked on-chain within the vault when the vault is created.

When a Vault Creator launches a vault, they pay the yield upfront, which is securely deposited into the vault. This ensures that Vault Subscribers receive their returns if they participate.

In simple terms, the yield is funded by real users taking strategic positions, not from protocol giveaways or someone else losing money. It is sustainable, market-driven, and backed by genuine economic activity.

So, Why Do Vault Creators Offer Yields?

And yes, that begs the question: why would someone offer those yields in the first place?

Vault Creators use DCI vaults for two main purposes:

- To hedge their crypto holdings against potential losses.

- To earn higher returns through protected leverage.

Hedging Against the Market

Here’s where the reverse insurance analogy really fits.

Think of it like buying car insurance. You pay a small premium so that if your car crashes, you do not bear the full financial loss. In Prodigy.Fi, it is reversed. Vault Creators are the ones paying the premium (yield) to protect their crypto position, while Vault Subscribers earn that premium by taking on the risk.

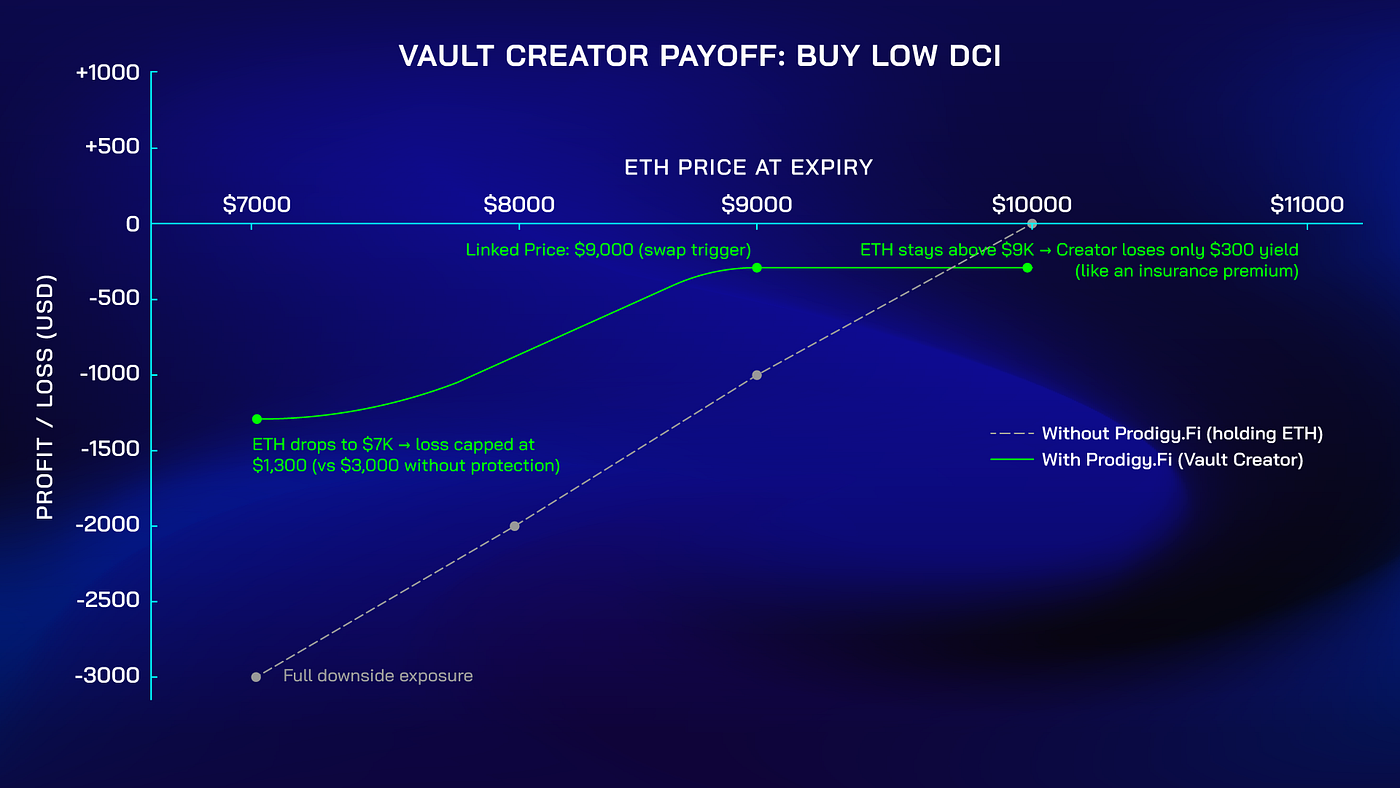

Example:

- If ETH is $10,000, a Vault Creator might set up an ETH Buy Low vault with a Linked Price of $9,000, offering $300 in yield.

- If ETH falls to $7,000, a swap occurs at expiry, allowing the Vault Creator to sell ETH at $9,000 instead of $7,000. Their total loss is capped at $1,300 (including the $300 yield paid) instead of losing $3,000 outright.

- If ETH stays above $9,000, the Creator simply loses the $300 yield, similar to paying an insurance premium you never claim.

Vault Subscribers, on the other hand, are like the insurers. They collect the premium ($300 yield) for agreeing to take on the risk of being swapped.

Reverse insurance in action: You are not buying protection, you are getting paid to provide it.

Earning Higher Returns

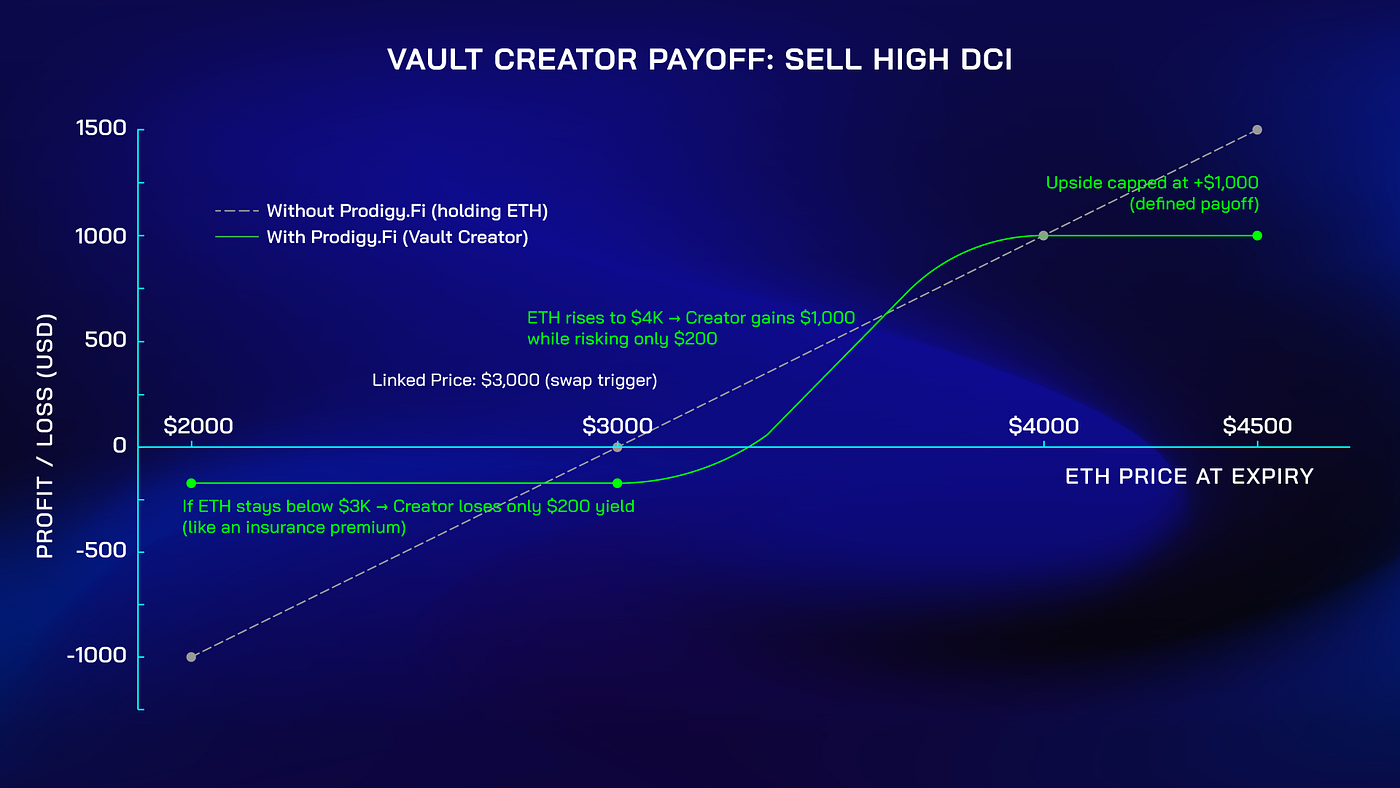

Vault Creators also offer attractive yields because DCI vaults let them amplify potential returns while limiting their losses. By setting target buy or sell prices (called Linked Prices), they can position for upside if the market moves in their favour while their maximum loss is capped at the yield paid to Subscribers.

Example:

- A Vault Creator sets up an ETH Sell High vault with a Linked Price of $3,000 and offers $200 in yield to Vault Subscribers.

- If ETH rises to $4,000, a swap occurs at expiry, allowing the Vault Creator to buy ETH at $3,000, netting a $1,000 gain while risking only the $200 yield they paid.

- If ETH stays below $3,000, they lose only the yield. Again, like paying a small premium for a chance at leveraged upside.

This leverage-driven payoff is why creators are comfortable paying high yields. It’s the cost of strategic positioning, not reckless gambling. They are rewarding Vault Subscribers to take the other side of a trade, in the same way insurers are paid to take on defined risks.

Okay, Think of DCIs Like Reverse Insurance

When you buy car insurance, you pay a monthly premium so that if you crash, you do not bear the full financial loss. The insurer collects that premium, knowing they might have to pay later but most of the time, they simply earn steady income for taking on the risk.

In Prodigy.Fi, Vault Creators are like policyholders, paying a small premium (the yield) to hedge their downsides, which protects themselves against potential losses in volatile markets. Vault Subscribers are like insurers where they earn that premium in exchange for taking on a defined amount of risk.

So, it is a win-win situation:

- Creators gain protection and flexibility.

- Subscribers earn predictable yield for assuming calculated risk.

And because these contracts typically last just 24–48 hours, they are short, transparent, and flexible. No hidden leverage and yes, no one is getting squeezed. Just a fair exchange of risk and reward.

Prodigy.Fi Yield Mirrors Option Premiums

In traditional finance, option buyers pay sellers a premium for the right to buy or sell an asset later. That premium compensates the seller for taking on risk. DCI vaults follow the same logic:

- Vault Creators act like option buyers, paying yields for protection or leverage.

- Vault Subscribers act like option sellers, earning yields by accepting potential market risk.

Yields in DCI vaults, like option premiums, are influenced by real market conditions:

- Market Volatility: Bigger price swings mean higher yields due to greater uncertainty.

- Time to Expiry: Longer vault durations mean greater exposure, resulting in higher yields.

- Linked Price Proximity: Vaults with target prices closer to the current market level carry higher swap probability and therefore, higher yields.

Since Prodigy.Fi’s DCI vaults are directly influenced by real market forces, yields naturally adjust with volatility and demand. When the market becomes more volatile, yields rise, transforming uncertainty into opportunity.

Mathematical models, like the Black-Scholes model, combine these factors, along with other metrics like Delta price sensitivity and Theta time decay, to set a fair premium, ensuring it reflects the real risks and rewards for both Vault Creators and Vault Subscribers in a balanced and efficient system.

So, when people ask, “Why is Prodigy.Fi’s yields so high?” the answer is simple: Because volatility has value and Prodigy.Fi turns that value into opportunity. Vault Creators pay for leverage, protection, or peace of mind while Vault Subscribers earn real, sustainable yields for taking on defined risk. It is a transparent, market-driven system where both sides benefit.

More insights, less fluff. Follow to keep learning.

✱ Website: https://prodigy.fi/

✱ Web App: https://mainnet-base.prodigy.fi/earn

✱ X: https://x.com/ProdigyFi

✱ Telegram: http://t.me/@prodigyfi

✱ Discord: https://discord.gg/PBKGN76YDn

✱ Youtube: https://youtube.com/@prodigyfi_official